With a $4-trillion market cap, India is now the fifth most valued market in the world, data from various exchanges showed. The US tops the league table with an M-cap of around $48 trillion, with China next at close to $11 trillion. With a market value of close to $6 trillion, Japan is at the third place while Hong Kong is fourth with $4.7 trillion.

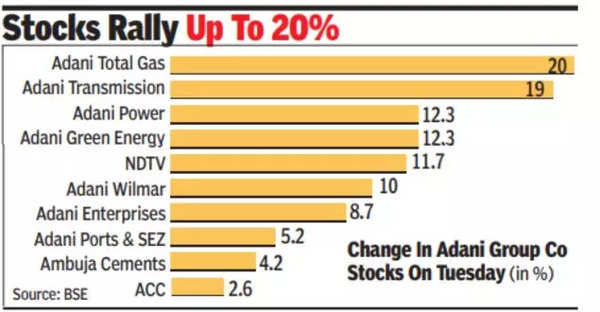

Stocks of all the Adani Group companies rallied by up to 20% on Tuesday after the Supreme Court late last week said that it didn’t find any fault with Sebi’s investigations in the Hindenburg issue.

The day’s rally also added about Rs 1.1 lakh crore to investors in the Adani group’s shareholders with the combined market cap of these companies now at Rs 11.3 lakh crore. It was the best day for the group’s stocks in terms of gains since late January this year.

On Tuesday, Adani Total Gas rallied 20% while group flagship Adani Enterprises closed 8.7% higher. Both the stocks had hit their respective upper circuit limits. Among the other major gainers were Adani Transmission, up 19%, Adani Power and Adani Green Energy, both up 12.3% and NDTV, up 11.7%.

Adani-Hindenburg case: SC reserves judgment, says no reason to discredit SEBI

After the Hindenburg report was made public, within five weeks the group’s total market cap had dipped from Rs 19.2 lakh crore to below Rs 7 lakh crore. The group has recovered part of those losses, data showed.

The group’s stocks had come under heavy selling earlier this year after a US-based short seller, Hindenburg Research, came out with a report alleging serious corporate malfeasance on the part of the group. The group has denied the charges. Sebi had started an investigation which was being monitored by the Supreme Court after cases were filed. The apex court had the last hearing on Friday and has now reserved its judgment in the case.

Since there were no major adverse observations in the case by the SC during the hearing, market players are taking it as a positive cue for the group’s stocks to rally, said a dealer with a domestic brokerage.

There are also rumours about global investors eyeing stakes in various companies.