So should you buy gold this Dhanteras 2023? Is it a good investment bet? Here’s what experts have to say about gold buying and the likely returns:

Piyush Gupta, Director – Research at CRISIL Market Intelligence and Analytics points out that domestic gold prices have gained 11% in the current calendar year till November 6, 2023 compared with 7% for equity markets (represented by Nifty 50); for the one year period ended the same period, gold is up 21% versus 7% for equities.

New Gold Hallmark Rules: How to check gold purity stamp before buying; know new hallmarking rules

Gupta believes that the sharp gain in the prices of the yellow metal in the past one year have been on the back of geopolitical tensions due to its stature as a safe haven asset. “Given its low correlation with other asset classes such equity and debt, it helps mitigate risk and acts as an effective portfolio diversifier during times of uncertainty,” Gupta tells TOI.

However, Piyuhs Gupta says that investment in gold may be a better bet through the ETF route rather than physical gold. “While, traditionally during religious festivals such as Dhanteras, physical gold (jewellery, coins and bars) is bought, however in this form, it carries the risk of theft, and hassles of impurity, making charges, prices volatility, etc. Instead, gold exchange traded funds (ETFs) and gold fund of funds (FoFs) offered by mutual funds are a convenient way of investing in the precious metal through the electronic route,” he advises.

According to an ET report, gold prices have seen a decline of Rs 1,000 per 10 grams in November, with silver prices dropping by Rs 1,300 per kilogram. Nirpendra Yadav, Senior Commodity Research Analyst at Swastika Investmart, predicts that MCX gold prices might range between Rs 64,000 and Rs 66,000 per 10 grams in 2024, with a critical support level at Rs 56,000. Meanwhile, MCX silver contract prices are expected to reach levels between Rs 78,000 and Rs 80,000 per kilogram in the coming year.

Gold Buying Tips: Sovereign Gold Bonds Vs Gold ETFs, Gold MFs Vs Gold Coins, Bars, Jewelry Explained

These projections imply a 10% increase in gold and a 13% gain in silver over the current market prices—Rs 59,894 for gold and Rs 70,371 for silver, the report said. Yadav suggests gold as a secure investment option, emphasizing its cultural significance during Diwali and noting that geopolitical tensions globally will likely support the prospects of bullion.

Devender Singhal, fund manager at Kotak Mutual Fund, highlights the attractiveness of gold as an asset class, particularly during times when the Federal Reserve is anticipated to pivot. Singhal recommends investors to maintain a “slightly overweight” position in gold.

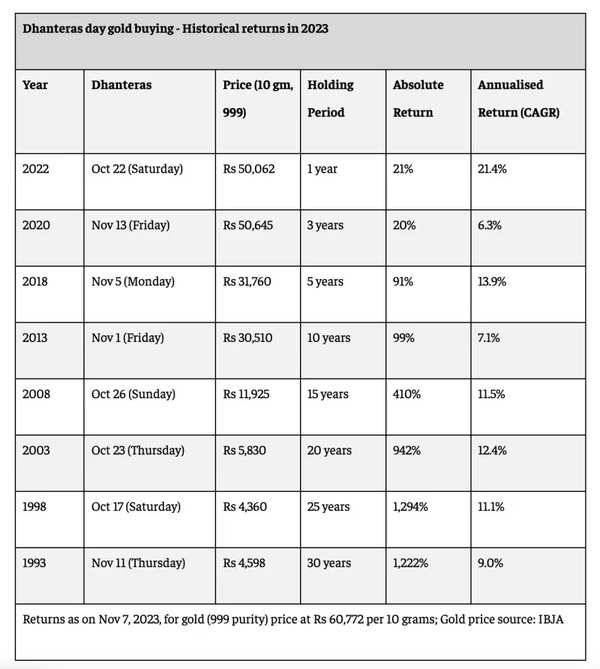

Gold historical returns (Source: ET)

Historically, gold investments made around Dhanteras have yielded double-digit returns over the long term. Surendra Mehta, National Secretary at IBJA, notes that gold has consistently provided good returns, making it an effective hedge against other asset classes. The 5-year returns on Dhanteras gold investments range from 13.9% in 2018 to 7.1% in 2013, with highly rewarding returns for 15-, 20-, and 25-year periods, all exceeding 11%, the report says.