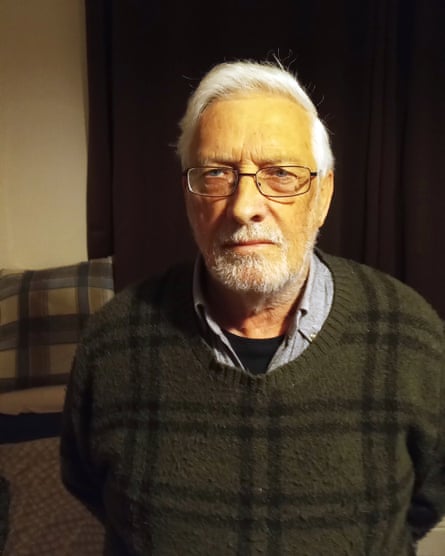

Guy Eyres, 77, a pensioner from Llandudno, Wales, is one of millions of Britons who have been affected by fiscal drag – the stealth taxation of income via the freeze on thresholds in place since 2021.

The UK government’s decision not to raise income tax thresholds in line with inflation despite a surging cost of living crisis has been lucrative for the Treasury: the OBR estimates the move will raise an additional £26bn by 2028.

That extra revenue is generated because many workers and pensioners have been given pay rises to offset inflation, pushing more low earners into the 20% basic-rate income tax bracket, which kicks in at £12,571, and tipping more people with earnings nearing £50,000 into the higher 40% rate, which kicks in at £50,271.

Eyres is one of those pensioners who has been fiscally dragged into the basic rate band, which he says has put significant pressure on him and his wife, Mavis, 75, over the past two years.

“My wife and I previously paid no income tax on our pensions,” the retired civil servant says. “Then last year we started paying tax, after our pensions increased.”

The small inflation increases have also resulted in the couple’s housing benefit and council tax support being cut.

“Our annual household income is now around £18,500 after tax. We still rent, costing £725 a month, and are very modest. But when my wife was diagnosed with cancer this July, that put substantial financial strain on us, because of the fuel costs for journeys to the hospital,” Eyres says.

“We can’t afford to put the heating on for more than two hours a day now. Many people are in a similar position.”

One GP from the south-west of England, speaking to the Guardian anonymously, talks about planning to reduce working hours to circumvent paying more income tax because of the frozen tax threshold in the higher 40% rate bracket.

“Like many of my colleagues I have young children and claim funded childcare hours,” says the thirtysomething family doctor. However, the doctor points to the “tax cliff edge at £100,000”, where if a household earns this much or above it loses this funding.

“This is coupled with the loss of the personal allowance from earnings over £100,000, which results in a marginal tax rate of 62% including national insurance. Factor in pension contributions and student loan repayments, and I would only take home 15.5p for every pound earned.

“I did some calculations and realised that, factoring in the loss of childcare hours and the higher tax band, I would need to earn about £120,000 to ‘break even’ with earning just below £100,000.

“As a result, after Christmas I’m reducing my hours to keep my earnings down. This means at the busiest time of the year for the NHS I’ll be sitting at home twiddling my thumbs when I could be at work seeing patients.”

Reducing hours to stay below the £100,000 income threshold was, they added, “a regular topic of discussion” among colleagues. “It’s utter madness. Apologies to patients who can’t get in to see me in February and March. I’ll be back in April.”

Many medium and higher earners who have been dragged into a higher tax bracket try to escape higher marginal taxes by paying more into their pensions to reduce their taxable income; other workers, particularly younger ones, are unable to do so.

Maria lives in Reading and works in central London as a media marketing lead. The 37-year-old, who asked only to be identified by her first name, was one of several millennials who shared with the Guardian that their living costs were too high to use pension saving as a way to reduce income tax – either because they were still renting and saving for a house deposit, had high mortgage or childcare costs, or were still paying off student loans.

Maria says a promotion last year pulled her into the higher-rate tax bracket. “My salary is now £55,000 plus bonus, but I also have a student loan, so I effectively pay 50% tax. I don’t currently pay into my pension because my tax is so high. I can’t afford to live and save and pay into my pension as well.

“It massively concerns me that I have no pension, as well as the fact that my mortgage is due to run out next year, meaning my money will likely be squeezed further [due to higher interest rates].

“Why is [so much of] the tax burden falling on to normal working people, especially millennials? I am in the top 10% of earners, you might say I should pay more tax. But then look at my finances – I do have a mortgage, but only for a one-bed flat which I can’t afford to move out of due to interest rates and house prices. I have to live miles away from my office to be able to afford to buy.”

Like many others who shared their views, Maria feels the young and middle-aged have a much rougher deal financially than older generations.

“Thirty years ago, if I had worked in media management, in my mid-30s, in the top 10% of earners, I would have had a four-bed house in the suburbs and be able to comfortably sustain a family. Now you have the mega-rich, and everyone else foots society’s bill and has a much lower quality of living. And then the Tories are talking about cutting inheritance tax, which again would only benefit the rich.”