How do you view growth numbers here in India?

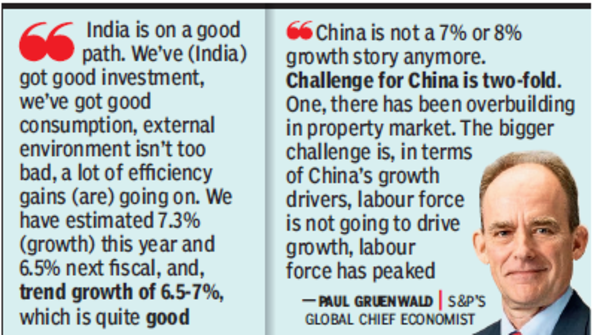

Emerging markets are growing faster than developed countries. But, India seems to be the star.Now, it’s definitely past China in terms of growth rate, there’s some catching up to do. India is on a good path. We’ve got good investment, we’ve got good consumption, the external environment isn’t too bad, a lot of efficiency gains (are) going on. We have estimated 7.3% (growth) this year and 6.5% next fiscal, and, trend growth of 6.5-7%, which is quite good. Looks like we’re firing on all cylinders right now.

What are the risks that you see?

The risk globally is one — we just had the fastest rise in interest rates in four decades. Every major central bank raised rates by 400 or 500 basis points. In some countries, those pass through very quickly and in other countries like the US, those pass through very slowly. We have maturity walls, we have resets of debts, we have changes in the demand for things like commercial real estate. We don’t see any potentially dangerous, (or) big changes, but economies have to adjust to higher rates. Geopolitics is a risk, (although) it’s been mostly contained so far. Even though the baseline is pretty favourable, we always have a list of risks that we’re watching.

What about China?

China has been the driver of global growth for two-three decades. China alone has been responsible for one-third of growth this century and China is not a 7% or 8% growth story anymore. The challenge for China is two-fold. One, there has been overbuilding in the property market. The bigger challenge is, in terms of China’s growth drivers, labour force is not going to drive growth, the labour force has peaked. The baseline is China’s five-ish (5%) growth over the medium term, if they’re unable to drive productivity that number would come down. Since China’s the biggest driver of global growth, that’s a negative for global growth.

India is the new rock star?

Among the major economies, India’s clearly the one that’s growing the fastest. China’s been the number one driver of growth, followed by the US, but just numerically, India could potentially, challenge the US as new number two growth driver, depending on what exchange rate you use. But, if we trend growth of 6-7% for rest of this decade, that puts India in pretty good shape.

PM Narendra Modi has been talking about next set of reforms. What is your wishlist?

The question for me about India is can India get to middle income status and beyond, which is what it’s aiming for without going through same kind of manufacturing and export process that all of east Asia is doing. It started with Japan, and then it went to (Asian) Tigers, then China, and now it’s going to Vietnam. We don’t have a road map. Starting with Britain to rest of Europe and the US, every country has gone through a manufacturing boom. India doesn’t have zero manufacturing. Is there a manufacturing-light, services-heavy path that achieves that? The thing to measure is productivity, which is the driver of all economic growth. If there’s productivity, India’s going to be able to do it. It started with back office and services. My gut feeling is India is never going to be a manufacturing/slash export powerhouse the way China was. It is going to have a different path. But there’s a real question of whether that can be done in a way that keeps productivity growth high and gets to middle income zone that India wants to go into.

When do you see US Fed finally cutting rates?

Fed has been super consistent in saying that it needs evidence inflation is on a clear downward path before it starts cutting rates. If you look at the most recent numbers, core services inflation, which is the one they watch, is wobbling around three-ish (3%). We’ve made a lot of progress but I don’t think they’re fully comfortable with starting to cut yet. We think they’re going to start (cutting) in the middle of the year, and probably have three cuts this year.