Market players said that ahead of the Lok Sabha poll results on June 4, investors are booking profit and taking some money off the table – hence the barrage of selling at every rise in the leading indices.In Monday’s market, after the initial rally, volatility jumped and the sensex lost over 800 points from the day’s high due to all-round selling. Finally, it settled flat, just 20 points down at 75,391 while Nifty closed 25 points down at 22,932.

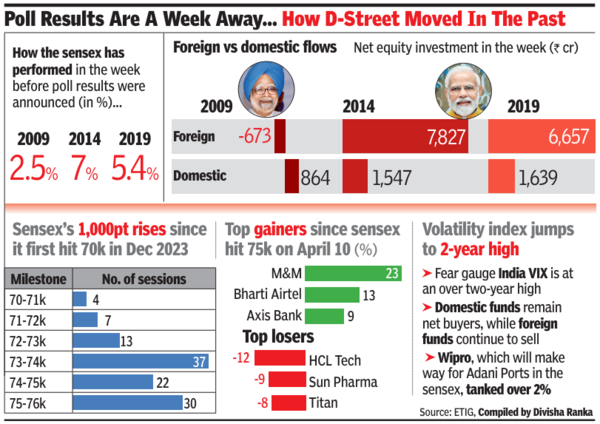

As volatility spiked, the India VIX scaled a new multi-year peak at 26.2 – a level not seen since March 2022. During the day, it was up almost 21% on intraday volatility but closed with a gain of 6.8%. As has been the case in the recent few weeks, on Monday too, foreign portfolio investors were net sellers at Rs 541 crore while domestic institutional investors were net buyers at Rs 923 crore.

According to Vinod Nair of Geojit Financial Services, the market is facing stiff resistance at higher levels as investors are booking profit at every rise in leading indices to avoid knee-jerk reactions in the market ahead of the election results next week. “Better earnings growth, the expectation of a revival in private capex, and a moderation in FPI selling intensity are the key positive triggers in the market. The release of India’s Q4 GDP and US inflation figures this week will also influence investors to get a direction in the near term,” Nair said.

The day’s session saw a marginal Rs 8,000 crore drop in BSE’s market capitalisation which settled at a tad below Rs 426 lakh crore. Among the 30 sensex stocks, 18 closed in the red. Reliance Industries, ITC and M&M contributed the most to the index’s loss, BSE data showed. In the broader market, there were 2,323 stocks which closed with losses compared to 1,650 stocks that closed higher.