Introduction: UK wage growth slows, but beating inflation

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

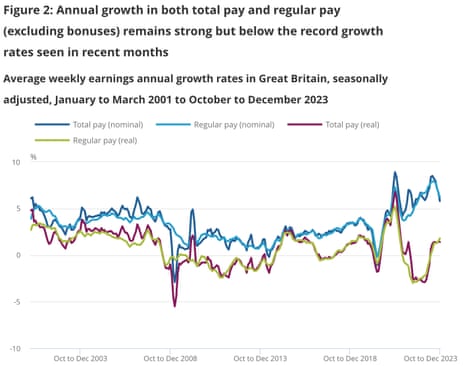

UK wage growth has slowed, as the jobs market continues to cool, but continues to outpace inflation.

Average earnings (excluding bonuses) grew by 6.2% per year in the October-December quarter, new data from the Office for National Statistics this morning shows, down from 6.7% the month earlier.

Total pay growth (including bonuses), slowed to 5.8% from 6.7%.

Both readings are higher than the City expected.

Much, but not all, of this wage growth is being eaten up by inflation, which ended 2023 at 4%.

If you strip out CPI inflation, then real total earnings rose by 1.6%, and regular pay grew by 1.9% – growth was last higher in July to September 2021.

That should help workers through the cost-of-living squeeze, but may disappoint the Bank of England which is looking for signs that inflationary pressures are easing.

Today’s jobs report also shows that the number of payrolled employees in the UK rose by 31,000 between November and December 2023, and rose by 401,000 over the year.

The unemployment rate has dropped to 3.8%, a rate last seen a year earlier in October to December 2022.

The employment rate rose to 75.0%, but the ONS warns that employment growth has slowed.

And the economic inactivity rate remains worryingly high at 21.9%, having been driven up last year by a rise in long-term sickness.

ONS director of economic statistics Liz McKeown says:

“It is clear that growth in employment has slowed over the past year. Over the same period the proportion of people neither working nor looking for work has risen, with historically high numbers of people saying they are long-term sick.

“Job vacancies fell again, for the nineteenth consecutive month. However, there are signs this trend may now be slowing.

“The number of days lost to strikes went up in December, with the majority coming from the health sector.

“In cash terms earnings are growing more slowly than in recent months, but in real terms they remain positive, thanks to falling inflation.”

The agenda

-

7am GMT: UK labour market report

-

10am GMT: ZEW index of eurozone economic sentiment index

-

1.30pm GMT: US inflation report for January

Key events

The UK labour market “continues to face challenges” as wage growth falls and long-term sickness remain historically high.

So says Ben Harrison, Director of the Work Foundation at Lancaster University, adding:

“For millions the cost of living crisis is not over, and yet the tide is continuing to turn on pay.

“Data shows there are now 2.8 million people who are economic inactive due to long-term sickness, which is at one of the highest levels since records began in 1993.

The recently revised ONS figures show that since before the pandemic, the UK now has just under 700,000 more working age adults out of the labour market due to work due ill health.

Chancellor of the Exchequer Jeremy Hunt has welcomed the news that real wages (earnings adjusted for inflation) have risen again, saying:

“It’s good news that real wages are on the up for the sixth month in a row and unemployment remains low, but the job isn’t done.

Our tax cuts are part of a plan to get people back to work so we can grow the economy – but we must stick with it.”

Pay growth slows: what the experts say

City experts believe the Bank of England will want to see a larger drop in pay growth before it feels confident it can cut interest rates.

Hugh Gimber, global market strategist at JP Morgan Asset Management, explains:

The recent trend lower in inflation, while good news, has largely been driven by a collapse in goods prices. The key watch item for the Bank lies in whether consumption reaccelerates as consumers find their feet. This would be good for growth but would also present upside risks to inflation, particularly in services sectors where prices tend to be more closely linked to wages.

As a result, with today’s print pointing to some signs of slowing in a still strong labour market, significantly more evidence of cooling is likely required before the Bank is ready to consider cutting rates.”

Jake Finney, economist at PwC UK, predicts that workers will see inflation-beating pay rises this year:

“The latest data suggests the UK has achieved its sweet spot, with declining vacancies taking the heat out of the labour market whilst unemployment remains relatively flat. This view is supported by the nominal pay growth data, which continues to soften.

“However, the lingering concern for the Bank of England will be that the labour market has not cooled sufficiently to achieve a sustainable return to the 2% inflation target. This remains one of the key barriers to the base rate cut in May that markets are currently expecting.

“More positively, workers will welcome that pay is now growing in real terms. With inflation declining at a faster pace than pay growth, workers are likely to see real term pay rises throughout most of 2024.”

Ashley Webb, UK economist at Capital Economics, says the slower-than-expected easing in wage growth may mean the Bank doesn’t need to rush to cut interest rates (but tomorrow’s inflation report will also be important):

While wage growth fell further in December, evidence that the labour market may not be loosening much suggests wage growth may not fall as fast as we expect.

Not too important if UK enters shallow recession, Bank of England’s Bailey says

Today’s jobs data comes in a busy week for economic news – with inflation statistics due tomorrow, followed by GDP on Thursday.

The growth figues may show that Britain fell into a technical recession at the end of 2023.

But last night, Bank of England governor Andrew Bailey said last night that he wasn’t overly concerned about a small drop in GDP in October-December.

Speaking after giving a lecture on banking at Loughborough University, he said he wouldn’t “put too much weight on that,” explaining:

“If we do get two successive negative quarters … it will be very shallow. What I would put more weight on is that the indicators we have seen since have shown some signs of upturn.”

Introduction: UK wage growth slows, but beating inflation

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK wage growth has slowed, as the jobs market continues to cool, but continues to outpace inflation.

Average earnings (excluding bonuses) grew by 6.2% per year in the October-December quarter, new data from the Office for National Statistics this morning shows, down from 6.7% the month earlier.

Total pay growth (including bonuses), slowed to 5.8% from 6.7%.

Both readings are higher than the City expected.

Much, but not all, of this wage growth is being eaten up by inflation, which ended 2023 at 4%.

If you strip out CPI inflation, then real total earnings rose by 1.6%, and regular pay grew by 1.9% – growth was last higher in July to September 2021.

That should help workers through the cost-of-living squeeze, but may disappoint the Bank of England which is looking for signs that inflationary pressures are easing.

Today’s jobs report also shows that the number of payrolled employees in the UK rose by 31,000 between November and December 2023, and rose by 401,000 over the year.

The unemployment rate has dropped to 3.8%, a rate last seen a year earlier in October to December 2022.

The employment rate rose to 75.0%, but the ONS warns that employment growth has slowed.

And the economic inactivity rate remains worryingly high at 21.9%, having been driven up last year by a rise in long-term sickness.

ONS director of economic statistics Liz McKeown says:

“It is clear that growth in employment has slowed over the past year. Over the same period the proportion of people neither working nor looking for work has risen, with historically high numbers of people saying they are long-term sick.

“Job vacancies fell again, for the nineteenth consecutive month. However, there are signs this trend may now be slowing.

“The number of days lost to strikes went up in December, with the majority coming from the health sector.

“In cash terms earnings are growing more slowly than in recent months, but in real terms they remain positive, thanks to falling inflation.”

The agenda

-

7am GMT: UK labour market report

-

10am GMT: ZEW index of eurozone economic sentiment index

-

1.30pm GMT: US inflation report for January